How to easily budget money on a low income

Sponsored post| During my year on maternity leave, I had to think carefully about how I spend my money, especially when there is little coming in. Some months, only £500 was slipping into my account, and for the last three months, I earned absolutely nothing at all. It’s common knowledge that financial worries can lead to an array of mental health issues, so it’s important that any existing debts are managed, and budgets are watertight to prevent the risk of slipping into debt. Sometimes it’s not as straightforward just to reduce your overall spending. I’m lucky that I usually have a regular income, but over the past year, there was a real risk of overspending. I had to quickly work out how to budget my money while on a low income, and it’s not as difficult as you’d expect.

Creating a solid budget

The easiest thing you can do to start budgeting effectively is create a spreadsheet online, or create one on paper. On one side list all your income – including all government support and side hustles. If you can’t be certain you’ll receive it, or the amount you earn changes every month – for example by making sales on online platforms – don’t include it.

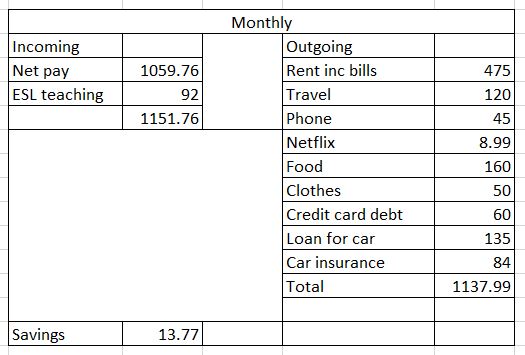

Then go through your bank statement and list everything that is a regular, monthly payment: rent, phone bill, Netflix, credit card bill. It might look a little like this…

As you can see, this person has a small amount left over that they could put into savings each month, but with rent, credit card debt, car loans, monthly car insurance payments, phone contracts, there’s a serious risk of you missing a payment if you’re not organised and happen to overspend.

Save, save, save!

I’m sure you all recognise the benefits of saving. You never know when you need new tires, or an outfit to your cousin’s wedding, or when an unexpected cost will hit your budget. Having a savings account alongside your current account can act as a really useful a safety net. However, £13.77 a month isn’t going to contribute much to a useful savings pot. Lots of sources recommend saving at least 20% of your income each month, but that can be incredibly difficult when trying to budget money on a low income. Getting as close as possible is a little more realistic.

How you can make your budget more manageable

On a low income, you unfortunately have to make sacrifices. Debts and contracts are things that you must pay, but you might have to think about ways to cut your spending. At this point, you might realise you have direct debits to services you don’t use. It was while doing this last year that I realised I was paying £19.99 for a gym membership I hadn’t used in two years… and rarely used before that.

Related: Prep machine to sleep aids: baby gadgets that saved my life

An easy way to make savings on your budget is revisiting how and where you spend. Saving takeaways and dinners out for special occasions could be an option, or shopping in alternative supermarkets for unbranded products. Walking short distances as opposed to jumping in the car saves a few pence in petrol. Perhaps instead of upgrading an expensive contract to get a new phone, keep the old phone (as long as it still works) and opt for a SIM only contract instead. This could slash your costs by £40 a month in some cases, and is definitely what I’ll be doing when my contract ends in July.

These are small changes which are insignificant if you are juggling debts. Something you could do look into consolidating debts, so that you are only making one payment instead of trying to coordinate paying three, four, or five. Thankfully, it’s not something I’ve had to do, but there are lots of places online where you can learn more about it.

Ultimately, budgeting is not as difficult as you might think. Once you know how to budget money on a low income, it can save you from falling into financial worries and concerns. After the last few years of disrupted employment, and now rising costs of fuel, food, and energy, it’s more important than ever to take control of your money.

Did you like this post? Why not let me know what you thought by leaving me a comment below? Or, if you want to keep up to date with new posts and any other financial discussions, you could follow me on Twitter or Instagram instead.

3 Comments

Corinne

I LOVE budgeting and knowing where my money is going. I love seeing what I have at the end of the money to put into savings. Maternity can be hard, I didn’t earn anything either in the last 3 months but I was transitioning into blogging too hard so thankfully I wasn’t hit too hard.

Corinne x

Georgia Alzapiedi

It’s so easy to slip into getting obsessed with budgeting, isn’t it!

I found it really tricky in the end, when all I wanted to do was go out for lunch and buy cute baby clothes. Glad you weren’t hit too hard in the last 3 months. x

Alice in Sheffield

I’m at the start of your journey! Due to start Maternity this month and absolutely dreading the lack of money but I’ve tried to save and squirrel away as much as I can to give myself a ‘wage’ especially on those last 3 months